The sixth-generation combat aircraft program, Future Combat Air System (FCAS), pursued jointly by France, Germany, and Spain, has again run into a storm.

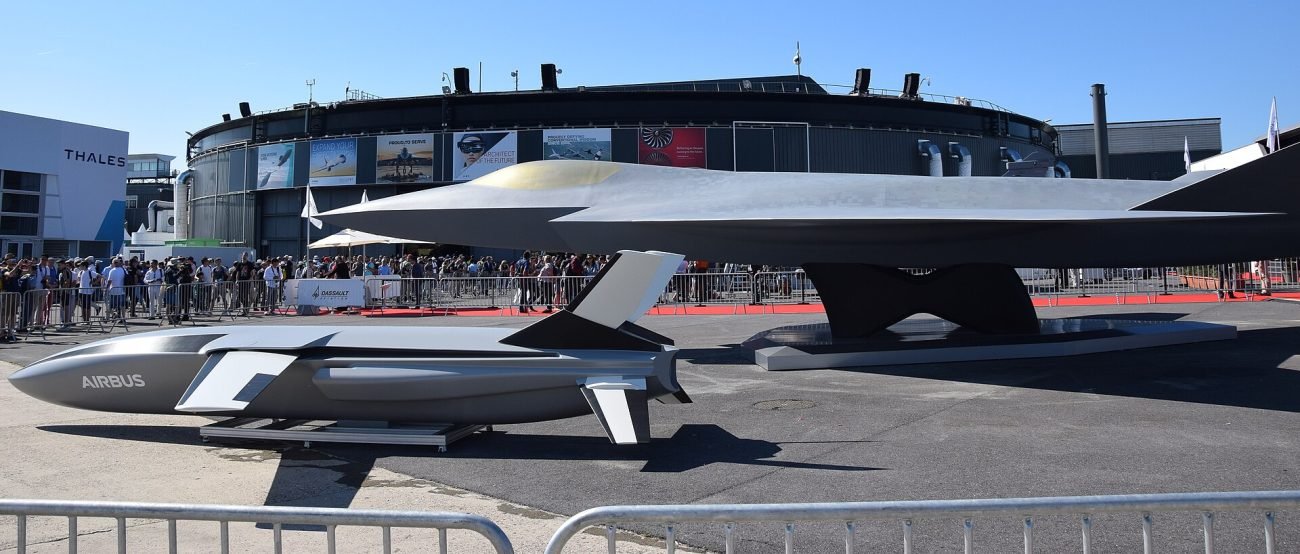

The differences between contractors Dassault Aviation, which represents France, and Airbus, representing Germany and Spain, have spilled over at the Paris Air Show.

Europe currently has two 4.5th-generation fighter jets—the French Dassault Rafale and the Eurofighter Typhoon, developed by the European consortium consisting of the UK, Germany, Italy, and Spain, led by Airbus.

Initially, France joined the multinational effort with the UK, Germany, Italy, and Spain to develop the “Future European Fighter Aircraft” (FEFA) in 1983. However, differences soon arose over design requirements and France’s indispensable need for a carrier-capable fighter.

France eventually quit the FEFA in 1985 and embarked on the development of its own 4.5th-generation aircraft, the Rafale.

Thus, Dassault Aviation and Airbus (which holds a 46% stake in the Eurofighter Typhoon) went from being potential collaborators to competitors.

Both companies aggressively pitch their aircraft to global customers, often competing head-to-head for lucrative contracts. The split that occurred decades ago has led to competition in technological innovation, with both companies vying to offer advanced avionics, stealth features, and multirole capabilities.

Things again took a turn when France and Germany decided to collaborate on the development of next-generation combat aircraft under the FCAS program in 2018. They were subsequently joined by Spain in 2019.

Dassault is the prime contractor for the New Generation Fighter (NGF), which is at the core of the FCAS program. Airbus serves as the main partner on behalf of Germany and Spain.

Since its inception, the FCAS program has faced numerous challenges, including disagreements over its design, budgeting, intellectual property rights, industrial work-sharing, and operational priorities. The three stakeholders have tried to make the arrangement work, but differences continue to arise, scuttling the plans to field the aircraft by the mid-2030s.

Public Spillover At Paris Air Show

The wrangling between Dassault and Airbus broke out at the ongoing Paris Air Show, once again throwing the future of the program into uncertainty. Dassault CEO Eric Trappier reiterated that only his company has the necessary skills to develop the NGF, dismissing the idea of sharing work on that project. Meanwhile, Airbus urged patience.

Trappier has maintained that the project should be led by Dassault and the French government. He recently said at a Bloomberg interview that a partnership centered on sharing work might result in a less-than-ideal technology solution.

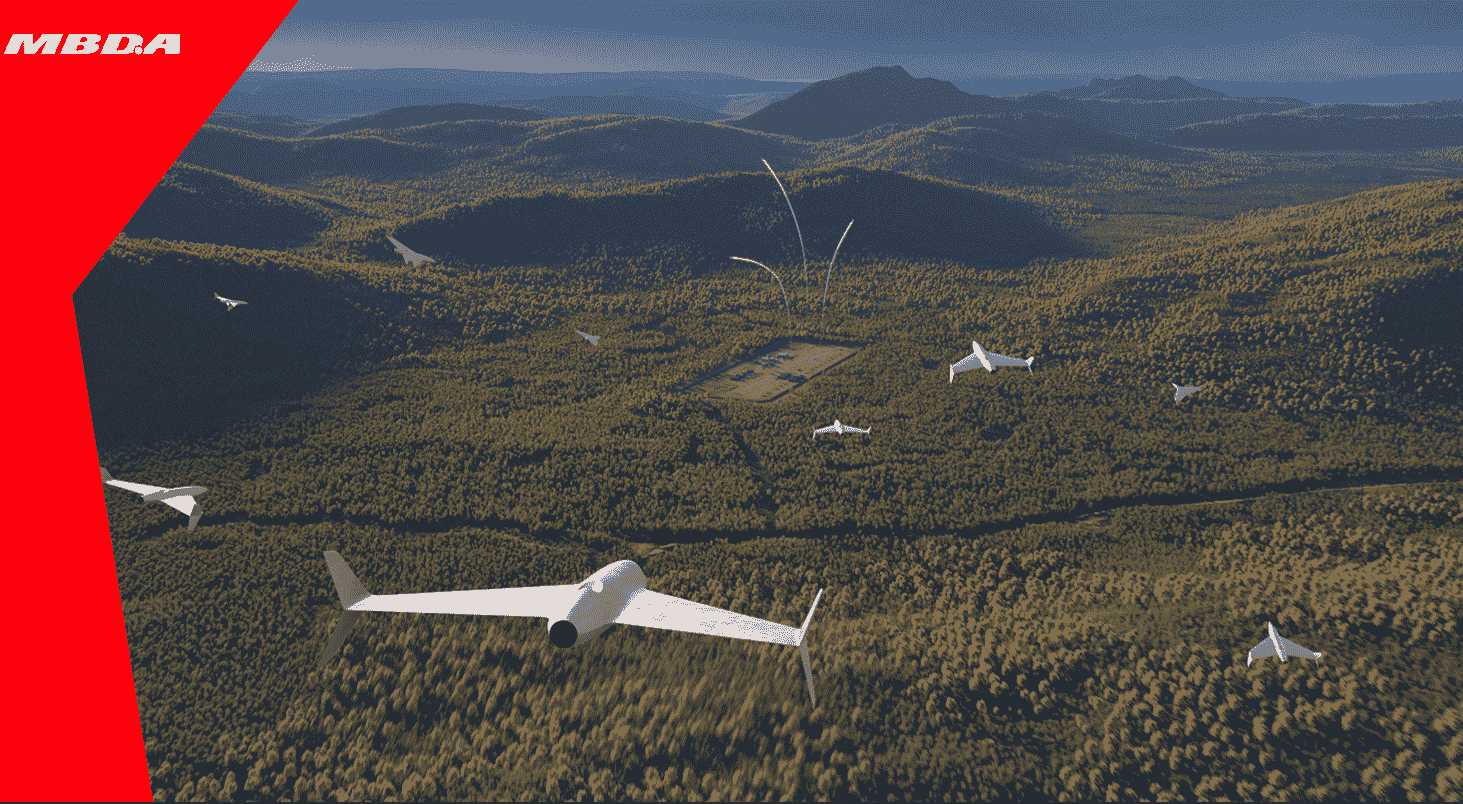

The program is divided into seven technical “pillars,” each headed by a different business and including contributions from subcontractors.

As previously reported, Airbus is in charge of the “loyal wingman” remote-carrier drone design, new cloud capabilities, and stealth technology, while Dassault is in charge of the new fighter plane. Safran is developing a new jet engine for the fighter, while Spain’s Indra is in charge of the sensor systems.

Responding to Trappier’s latest comments and Dassault’s unwillingness to cooperate in the development of the aircraft, Jean-Brice Dumont, the head of air power at Airbus, said, “I wouldn’t comment on what [Trappier] said, but any co-operation is not easy.”

“We do not challenge that Dassault is the lead for Pillar 1 [the NGF] of the NGWS, but there is an allocated work share [for each of the partner companies] that is detailed by the governments. I believe that with smart work share and rules of engagement, it is possible [for the project to proceed], but the will has to be there,” he added.

The conflicts, according to Dumont, are partially a result of two businesses joining forces in a union he compared to two people coming from different relationships. Dassault has been working on the Rafale, while Airbus has been working on the Eurofighter with Leonardo and BAE Systems.

He expressed optimism that the problems could be fixed. He said, “I believe it’s possible with smart workshare and the proper rules of engagement.”

Currently, the program is in Phase 1B, under which the industry partners are working on the research, design, and development of the NGF, which includes extensive work on propulsion, sensors, and communication systems. Once the development phase is over, the program will enter phase 2, which will include creating a demonstrator.

According to previous reports, Phase 2 is scheduled to be announced in 2026, with the first flight of the demonstrator planned for 2029. However, this can happen only if the two contractors can iron out their differences.

Eurofighter & Rafale Likely To See A Surge In Sales

The Dassault Rafale has secured significant export success since its first international sale in 2015. In addition to the French Air and Space Forces, the aircraft has been purchased by the air forces of eight countries, including Egypt, India, Qatar, the UAE, Greece, Croatia, Indonesia, and Serbia. Of these, the UAE placed the largest order for 80 fighters in 2021.

Indonesia, which has already acquired 42 Rafale fighters, is now considering an additional purchase. The Southeast Asian country signed a Letter of Intent (LoI) for an unidentified number of Dassault Rafale during a visit by French President Emmanuel Macron late last month. While this does not necessarily mean that an order has been placed, it indicates that a purchase is now under active consideration.

India recently became the first-ever customer of the Rafale-Marine aircraft, which is tailored for carrier operations. New Delhi signed a deal for 26 Rafale Marine in April this year at a whopping US$7.5 billion.

Separately, several defense analysts and Indian Air Force veterans have thrown their weight behind the acquisition of 114 Rafales for the Indian Air Force’s Multi Role Fighter Aircraft (MRFA) program.

Notably, Dassault Aviation also recently announced that it will manufacture the main body section or fuselage of its Rafale multirole fighter jets in India, marking the first time production has taken place outside France.

Saudi Arabia has reportedly been mulling the purchase of 54 Rafale fighter jets after being snubbed by the US for the purchase of F-35 Lightning II fighter jets. Several other countries, including Colombia, Morocco, and Iraq, have also shown interest in Rafale. Dassault will likely continue discussions with potential customers to sign contracts, perhaps for the more advanced F4 and F5 variants.

Not only that, but as European countries reconsider their F-35 purchase plans, Macron has urged them to abandon the F-35 and opt for the Rafale, portraying it as a more reliable alternative. Meanwhile, Rafale aircraft for Canada is an option as Ottawa reconsiders its ties with the US and is reportedly re-evaluating the F-35 plan.

Meanwhile, the Eurofighter Typhoon is undergoing somewhat of a renaissance itself. The 4.5th-generation aircraft has been acquired by countries including Austria, Saudi Arabia, Oman, Kuwait, and Qatar.

Currently, the CEO of the Eurofighter consortium is considering Austria, Greece, Poland, Portugal, Saudi Arabia, and Turkey as potential destinations for new export success. All of those prospects would add up to almost 100 aircraft.

While Turkey is currently eyeing about 40 Eurofighters, the export is contingent on the approval of Germany, a member of the consortium that has strict export control rules.

In April 2025, Germany blocked the proposed sale of Eurofighters to Turkey over the controversial arrest of Istanbul Mayor Ekrem İmamoğlu. The arrest has been lamented as politically motivated, as it came ahead of the mayor’s nomination as a 2028 presidential candidate. Germany takes a strict view of human rights violations.

According to journalist Gareth Jennings, Eurofighter CEO Jorge Tamarit Degenhardt said that there are still some hurdles to the export of the aircraft to Turkey, including one that is very sensitive. Nonetheless, the other members of the consortium, led by the UK, have been in touch with Turkey, optimistic about a positive response from Berlin.

Another country seriously exploring the option to purchase the aircraft is Saudi Arabia. Like Turkey, Saudi Arabia’s purchase of an additional 48 Eurofighters had been blocked by Germany owing to the kingdom’s twisted human rights record.

However, the export ban was lifted earlier this year, paving the way for a potential purchase. The kingdom, however, is yet to make an announcement.

According to Degenhardt, Riyadh’s long-standing desire to sign a repeat order through the UK government amounts to a “no-fail mission for the UK Ministry of Defence.” The UK has been relentlessly pushing for the sale of the aircraft to the kingdom.

In addition to these, Germany, Spain, and Italy have all placed follow-on orders for the aircraft in recent months.

Tamarit Degenhardt has also reportedly urged Germany, Italy, Spain, and the UK to agree to a key mid-life upgrade for the multi-role fighter, which will enable the aircraft to remain combat-ready into the 2060s and serve as a bridge to sixth-generation fighters.